EGR 206

This course teaches you how to solve and understand economics in the engineering field. Just solve these problems we would use the methods of depreciation. Problem-solving regarding cost and Engineering projects. Explain and solve problems with unequal services, cost, and lives. Many things are analyzed such as cost of public activities, income taxes, cost of operations, replacement cost, and reasons for replacements. Learning ways to solve problems of future projects and use spreadsheets.

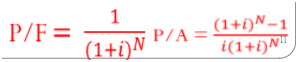

Bond value present worth

The commercial value of a bond is the present worth of all future net cash flows expected to be received– the redemption price (C), and the period dividend (face value (Z) times the bond rate (r)), all discounted to the present at the bond’s yield rate, i%.

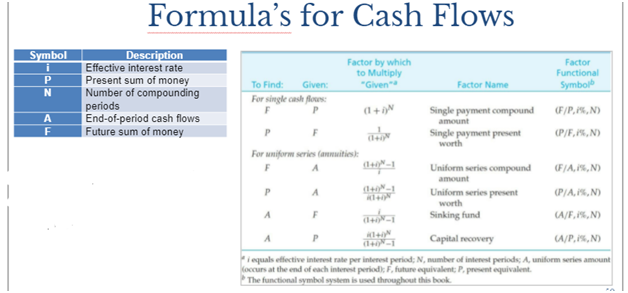

VN = Future Value Reflected to Present + Present Value of Annuity (periodic payments)

VN=C (P/F, i%, N) + rZ (P/A, i%, N)

Example

Tyler wants to buy a bond. It has a face value of $50,000, a bond rate of 6% (nominal), payable semi-annually, and matures in 10 years. Tyler wants to earn a nominal interest of 8%. How much should Tyler pay for the bond?

Future worth

Example

A $45,000 investment in a new conveyor system is projected to improve throughput and increasing revenue by $14,000 per year for five years. The conveyor will have an estimated market value of $4,000 at the end of five years. Using FW and a MARR of 12%, is this a good investment?

FW = -$45,000(F/P, 12%, 5)+$14,000(F/A, 12%, 5)+$4,000 (F/P,i%,N)=(1+N)N

(F/A,i%,N) = ((1+i)N -1)/i

FW = -$45,000(1.7623)+$14,000(6.3528)+$4,000

FW = $13,635.70