INTRODUTION:

Throughout history, the exchange of goods and services has manifested in various forms, evolving from the rudimentary barter system to the sophisticated digital currencies of today. Central to facilitating these exchanges have been financial institutions, trading organizations, and banking systems. With the advent of technology and the increasing interconnectedness of our global society, transactional processes have been revolutionized, giving rise to the emerging phenomenon of digital currencies. At the forefront of this discussion lies cryptocurrency.

WHAT ARE CRYPTOCURRENCIES? WHAT ARE SOME EXAMPLES OF CRYPTOCURRENCIEs

Essentially, cryptocurrencies represent a modern technological innovation in the realm of trading goods and services. They serve as online payment methods for transactions, enabling individuals to conduct digital payments for received goods and services. Acquired through the exchange of physical currency, cryptocurrencies can then be utilized within the ecosystem of the issuing company, akin to purchasing tokens in a casino.

However, the concept of cryptocurrency is not without its controversies. While proponents herald it as the currency of the future, critics argue that it lacks the fundamental qualities required for currency status, particularly stability. Furthermore, debates persist regarding its classification—whether it should be considered an investment or merely speculative in nature. Unlike traditional businesses that generate value through profitability and cash flow, cryptocurrencies rely on the principle of ‘the greater fool’ theory, where profits are contingent upon someone else paying more for the currency.

Despite these debates, the popularity and proliferation of cryptocurrencies continue to soar. With approximately 14,500 publicly traded cryptocurrencies according to Coin Market Cap, interest in these digital assets shows no signs of waning. Among the top 10 most popular currencies are Bitcoin, Ethereum, Binance Coin, and others, collectively contributing to a staggering total value of around $2.6 trillion. This burgeoning economy has attracted millions of users for myriad reasons, ranging from its potential as a future currency to its decentralization and purported security provided by blockchain technology.

In essence, cryptocurrencies represent a paradigm shift in the way we perceive and engage in financial transactions, offering both promise and uncertainty in equal measure. As the landscape of digital currencies continues to evolve, understanding their intricacies and implications becomes increasingly imperative.

WHAT IS A BLOCKCHAIN? WHAT IS IN THE BLOCK OF A BLOCKCHAIN?

HOW ARE THEY LINKED?

Mathematical definition: –

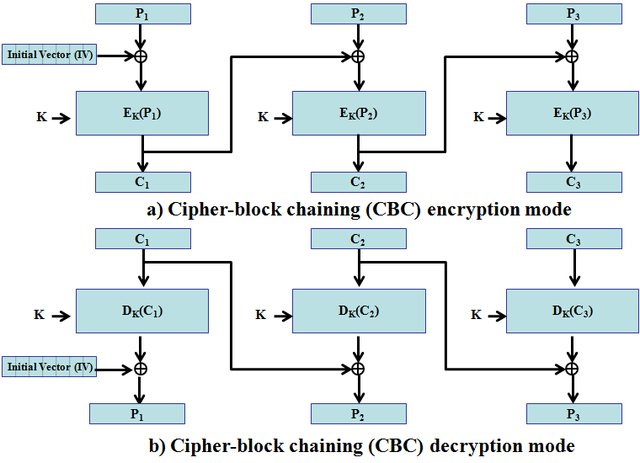

One of the modules recently covered in this class, specifically Module 5, delves into the mathematical underpinnings of blockchain technology. Within this module, a section elucidates the process by which blockchains operate. Initially, blockchain utilizes an IV (Initialization Vector) to initiate the creation of the first block. Subsequently, each subsequent block is generated from the previously created cipher block. It becomes evident that the most recently created cipher is a product of a chain reaction originating from the IV vector. This interconnectedness illustrates that each cipher is intricately linked to the others in a chain-like fashion. Blockchain comprises a growing list of records, or blocks, which are interconnected through mathematical links established by cryptography. Within each block, there exists a cryptographic hash of the preceding block. This design ensures the integrity and security of the blockchain. Below is a demonstration of blockchain functionality excerpted from Module 5.

Generalized definition:-

Blockchain represents a sophisticated and methodical digital ledger system meticulously designed to resist hacking, manipulation, and alteration of system data. It functions as a digital repository of transactions interconnected and dispersed across a network of computer systems within the blockchain framework. Each block in the chain is associated with numerous transactions, and the addition of a new transaction mandates its inclusion in every participant’s ledger. This collective ledger participation governs a decentralized database referred to as Distributed Ledger Technology (DLT).

Within a blockchain, a block comprises clusters of transactions that undergo hashing and encoding into a Merkle tree structure. Each block incorporates a cryptographic hash derived from the preceding block, thereby establishing a link between the two. This linking process continues sequentially until the final block is reached, forming a continuous chain. Employing digital signatures, this iterative procedure verifies the integrity of each preceding block, tracing back to the initial block, referred to as the genesis block.

WHEN ARE BLOCKS ADDED? WHO ADD THE BLOCKS —-CENTRALIZED SERVER OR DISTRIBUTIVE SERVERS? WHO MAINTAIN THE BLOCKCHAINS?

As previously mentioned, through the utilization of unique cryptographic algorithms, new transactions generate new blocks within the blockchain. This process is irreversible once completed. Miners, individuals possessing advanced mathematical skills, play a pivotal role in this process. They validate, verify, and append new blocks to the existing chain, ensuring the accuracy of these additions. Mining occurs within a peer-to-peer network established for the public distribution of ledgers, where nodes collectively adhere to a communication protocol to validate new blocks. This distributed process of data storage across peer-to-peer networks minimizes risks associated with centralized systems. Given that every node within the decentralized system maintains a copy of the blockchain, the upkeep of blockchain data and transactions is achieved through extensive database replication across the peer-to-peer computer network.

ARE THESE SCALABLE? IN OTHER WORDS, CAN THE CHAINS BE AS LONG AS YOU WISH THEM TO BE? WHAT IS THE PERFORMANCE IMPLICATION OF HAVING LONG CHAINS?

As outlined in the introduction of this document, blockchains, the foundation of cryptocurrency technology, serve as the primary method for online transactions of goods and services. However, to compete with established entities such as Visa and PayPal, which process 1667 and 193 transactions per second respectively, blockchain technology must enhance its scalability. Currently, blockchain can handle approximately 20 transactions per second, a rate deemed insufficient for widespread adoption. Due to its decentralized nature, blockchain operates on a trustless system. For instance, if node A validates a transaction, node B does not automatically accept its validity. Instead, node B conducts its own calculations to verify the transaction’s authenticity. Consequently, every node must possess its own copy of the blockchain to independently verify transactions. This decentralized verification process leads to inefficiencies, resulting in sluggish performance and extensive resource consumption. Given these limitations, achieving the desired speed and performance enhancements for blockchain technology presents a formidable challenge.

HOW IS CONSISTENCY MAINTAINED AMONG COPIES OF BLOCK CHAIN?

Within a blockchain, where there is no central authority, nodes engage in communication through a network utilizing a gossip protocol. This protocol entails a node sharing information with its neighboring node, which then passes it on to its own neighbors, and so forth. This decentralized communication occurs within a trustless system, wherein each node independently verifies the validity of transactions without reliance on trust. In the event of an invalid record, data from copies of the blockchain are utilized to rectify discrepancies, ensuring the consistency of the blockchain copies.

EXAMPLES OF APPLICATIONS WHERE BLOCK-CHAIN TECHNOLOGIES ARE BEING USED.

Originally, blockchain technology was developed for the purpose of facilitating money transfers. In comparison to traditional methods, blockchain-based transfers offer the advantages of being faster and less expensive. This is particularly evident in cross-border transactions, which often suffer from delays and high fees. Even within the modern U.S. financial system, where money transfers between accounts can take days, blockchain transactions are completed within minutes.

Beyond money transfers, blockchain technologies are also being utilized in the realm of real estate. Traditional real estate transactions involve extensive paperwork to verify financial information and ownership, as well as to transfer deeds and titles to new owners. By leveraging blockchain technology to record real estate transactions, a more secure and accessible method of verifying and transferring ownership is established. This innovation not only accelerates transactions but also reduces paperwork and saves money in the process.

ARE THESE CRYPTOCURRENCIES SECURE? IN OTHER WORDS, WHAT GIVES THEM THE PROPERTIES OF RELIABILITY, TAMPER-PROOF, AND UNIQUENESS (AVOID DOUBLE COUNTING)?

Empowered by robust cryptography that is exceedingly resistant to decryption, cryptocurrency is lauded for its security. The decentralized networks built on blockchain technology, which operate without a central authority, serve as safeguards against tampering and manipulation. In blockchain-based cryptocurrency systems, the issue of double-spending is mitigated through a consensus mechanism called proof-of-work. This mechanism is executed by a decentralized network of “miners” who not only uphold the integrity of past transactions recorded on the blockchain but also identify and prevent instances of double-spending.

WHAT HAS PUZZLE SOLVING TO DO WITH CRYPTOGRAPHY? WHY HAVE THEY BECOME POPULAR IN CRYPTO-CURRENCIES?

During the mining process, where miners endeavor to add a block or authenticate legitimate participants, cryptographic methods such as hashing play a pivotal role in efficiently verifying the integrity of transaction data on the network. Hashing not only preserves the structure of blockchain data but also encrypts individuals’ account addresses, serving as a crucial component in encrypting transactions between accounts and facilitating block mining.

In conjunction with hashing, digital signatures further enhance the security of transactions by enabling genuine participants to validate their identities within the network. As previously noted, cryptocurrency operates within a decentralized system, necessitating robust encryption of data and transactions, as well as authentication of participants, in the absence of a centralized authority. Cryptography emerges as the solution to address these fundamental requirements within the cryptocurrency ecosystem.

WHAT CRYPTOGRAPHIC TECHNIQUES THAT WE DISCUSSED DURING THE COURSE ARE BEING EMPLOYED IN THESE TECHNOLOGIES?

Among the techniques explored in this course, blockchain technology emerges as the cornerstone of cryptocurrency technology. Another significant technique is asymmetric encryption, which is vital for ensuring the security of cryptocurrency transactions and blockchain integrity. In the context of cryptocurrency, asymmetric encryption is employed in the private-public key exchange process to verify and authenticate cryptocurrency ownership. Additionally, hashing plays a crucial role in cryptocurrency transactions by encrypting data into a series of alphanumeric characters that bear no resemblance to the original data or transaction. This hashing process serves as an initial defense against fraudulent transactions and double spending of the currency within the cryptocurrency ecosystem.

WHAT ARE THE ADVANTAGES OF CRYPTO-CURRENCIES OVER PHYSICAL CURRENCIES OR OTHER DIGITAL CURRENCIES, SUCH AS CREDIT CARDS AND DEBIT CARDS?

Despite its original conception as a means of facilitating daily transactions and its aim to expedite transaction processing while circumventing central banking authorities, cryptocurrency has yet to achieve widespread popularity as a payment medium akin to platforms like PayPal and Visa, even a decade after its inception. However, cryptocurrency retains several inherent advantages over traditional payment systems.

Foremost among these advantages is its provision of a decentralized system, free from control by any central entity. Additionally, cryptocurrency offers lower transaction fees and faster transaction processing, particularly advantageous for international transfers. Moreover, its accessibility to individuals without bank accounts further adds to its appeal as an alternative form of currency. Despite these advantages, cryptocurrency still faces challenges in gaining broader acceptance as a mainstream medium of payment.

CITATIONS:

- https://www.nerdwallet.com/article/investing/cryptocurrency-7-things-to-know

- https://en.wikipedia.org/wiki/Blockchain#Structure

- https://www.euromoney.com/learning/blockchain-explained/what-is-blockchain

- https://www.igi-global.com/dictionary/has-bitcoin-achieved-the-characteristics-of-money/59928

- https://blockgeeks.com/guides/blockchain-scalability/

- https://www.investopedia.com/ask/answers/061915/how-does-block-chain-prevent-doublespending-bitcoins.asp

- https://www.investopedia.com/tech/explaining-crypto-cryptocurrency/

Birhane: compiled, organized and researched.